September 2021

Latest COVID Surge Hampering Factory Activity in Asian

By Christopher Ruvo

September 1, 2021

Manufacturing output is slowing in key production centers in Southeast Asia due to the rampant spread of COVID-19’s delta variant, making it more difficult and more expensive for western brands to get goods produced and shipped to North America.

The slowdown in activity has the potential to get worse in the weeks ahead in the wake of developments like stay-at-home orders issued by the government in Vietnam, a key country for the production of everything from apparel and shoes to upholstery.

The grim news comes as the global supply chain for virtually every industry is already in disarray due to COVID-caused complications.

The promotional products market is no exception. Rising raw-material prices,

congestion at ports, insufficient labor and domestic transport capacity, skyrocketing shortfalls, higher product prices, lower customer service levels, longer production times, shortages of important decorating materials like screen-printing ink, and delays in order delivery.

One thing driving up costs and making it harder and pricier to get promo goods manufactured is constraint on factories related to attempts to control outbreaks of the delta variant in Asia, where the vast majority of domestically sold promotional products are produced.

COVID clearly weighed on Southeast Asia factories in August, where manufacturing managers in Vietnam, Thailand, and the Philippines all reported deeper contractions in activity.

Want more to this story? Contact us now!

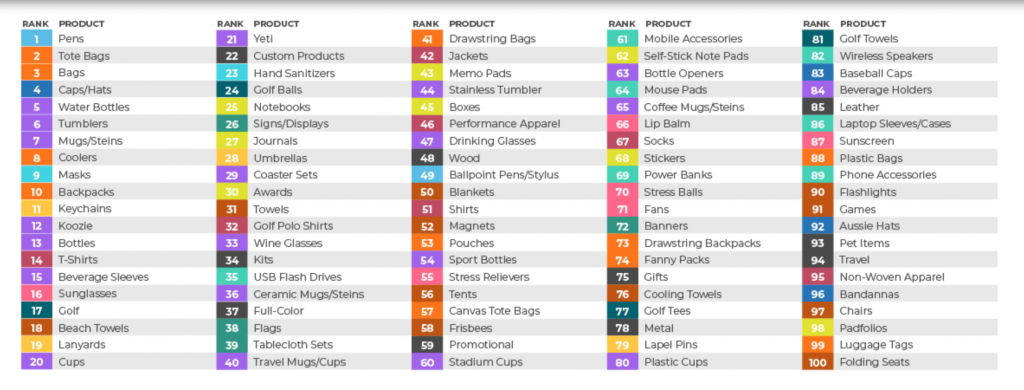

TOP 100 REQUESTED PROMOTIONAL PRODUCTS THIS SUMMER

There’s a changing of the guard in the most requested promotional products this summer. Masks, the usurper of the industry since 2020, were finally dethroned from the number-one spot, and pens have resumed their place at the top of the promo empire

July 2021

Help Wanted …. PLEASE!

You call your favorite supplier and you hear “sorry that is temporarily out of stock” or "sorry but due to the backlog in orders this might take 3 to 6 weeks longer than usual to get it to you."

What’s this all about?

Story adapted from

"Staffing Challenges Persist"

Original By Theresa Hegel

July 19, 2021

Last year, 41% of promo suppliers had to lay off employees, according to a recent State of the Industry report. This year, as the economy picks up and regular orders resume, many of those same suppliers are struggling to restaff.

According to an executive at one of the top promo suppliers. The company has about one-third fewer production workers than it did before the coronavirus pandemic began. “We’re unable to fill hundreds of open production positions, even though we’ve raised hourly rates at most positions, and we’re providing sign-on bonuses and cash rewards after 30, 60 and 90 days of service,” the executive reported.

Some companies have also implemented sign-on bonuses and adjusted pay scales to reflect the current market. They are also looking at different work schedules to accommodate nontraditional applicants.

Signing bonuses – some of which push into the thousands of dollars – are increasingly common. Some suppliers resorted to seeking out high-school age students to fill warehouse vacancies as a summertime stopgap. They’re turning to employment agencies for the first time to hunt down viable candidates. And when all else fails, they’re adopting an “all hands-on deck” mentality – with plenty of overtime included – to ensure orders are packed up and out the door.

Staffing shortages, combined with widespread supply chain issues, are taking their toll. An industry survey revealed that 14% of orders from suppliers were not fulfilled on time, compared to 10% in 2019.

Explanations for the staffing crisis abound. A big one is expanded unemployment benefits that are disincentivizing some from returning to the workforce. The reevaluation of careers and work-life balance are two that are heard during the recruiting process. Other factors include a reluctance to return to in-person work, potential childcare issues, and an increased desire for flexible scheduling. Plus, with so many sectors hiring, potential workers can be choosy about the positions they accept.

“It’s crazy right now with how many people are unemployed, yet all I see are companies begging for workers and can’t find any,” says Brayden Jessen, owner of a Spokane, WA-based design company. “We had several ads out for full-time employees and weren’t getting many responses.”

When they altered the ads and mentioned that part-time positions were also available, the decorator got more bites. Jessen’s last two hires are both part-timers, interested in learning more about apparel decorating – but not yet ready to give up the full-time positions they’ve been at for more than 15 years.

“Right now, I see employees having a lot of leverage,” Jessen adds. “Companies have to be more adaptable to how employees want to work. People have gotten used to being at home, having a more flexible schedule with kids, dogs, running errands, working out, etc. They want to continue that lifestyle without being tied to a desk 8-5. If companies can adapt to that, maybe we’ll have a much happier, productive work force.”

Flexibility has been key for many promo companies. “We’re going to be a hybrid going forward, 100%,” says the CEO of a promotional marketing company in Southfield, MI. “Flexibility is going to be our focus. We want to be able to offer different scenarios for employees.”

Remote work over the last year forced the team to get more comfortable with technology, and in some ways the distributor became more efficient. “Now that we’ve worked out the kinks with chat systems and virtual calls, communication is even better” than it was before the pandemic.”

Employers are also testing the idea of long-distance remote staffers. Brenda Speirs, head of Bend, OR-based company, recently hired a woman who lives in Connecticut to work on account management, bookkeeping and, eventually, sales. “This is an experiment,” Speirs admits. “I’m a little nervous that we can coach her the way she needs to be, but I know her, and I know her capability. I think it’s actually going to work great.”

Yvette Hymel, owner of a company in New Orleans, has an employee whose Coast Guard spouse was relocated to Guam. Though the employee initially thought she’d have to leave the company, Hymel was able to make her fully remote. “She still has her whole day to spend with her husband and puppy, and we get to have her back and know that she’s helping us stay on track,” Hymel says.

The pandemic has also changed what some employers are looking for in new hires. There’s the obvious – that workers need to be comfortable with technology. But there are also character traits becoming more desirable among certain hiring managers. Nick Davis, director of sales at In a local apparel supplier, says he’s looking for compassion rather than a rigid “hunter” instinct. “You want your sales rep to have that bravado and chutzpah, but you also want them to be a human being you can talk to,” Davis says. “I need someone that understands that this is life. I’m going to be as compassionate about you as I would expect you to be about me.”

Inventory Shortfalls, Higher Prices Loom for Promo’s Q4

By Christopher Ruvo

July14, 2021

Q4 just got more complicated.

Expect product shortages to impact the promotional products industry during what’s traditionally its busiest time of the year – the fourth quarter holiday gifting season. Further pricing volatility could come into play, too.

That’s the message from promo suppliers, who say the ongoing supply chain issues that have driven inventory shortfalls, increased prices on products, and led to delays in order fulfillment so far in 2021 will continue to affect the industry at least through year’s end.

Their plea to distributors? Get your Q4 orders in as early as possible, especially if clients want built-from-scratch custom pieces. Today wouldn’t be too soon.

“Customers who place orders earlier will get what they want,” says Jing Rong, vice president of global supply chain and compliance at Top 40 supplier HPG (asi/61966). “Those who wait until the last minute might only get what’s available.”

Inventory Gaps & Escalating Prices

In general, suppliers believe both hard good and soft good product categories will experience shortfalls, to varying degrees, at points during the remaining third quarter and the fourth. Some categories could fare worse than others.

“Bags, drinkware, and outdoor products are likely to be the most affected because they’ve had the quickest recovery in demand. And as such, they’re competing with retail for production capacity,” explains Sandeep Jain, vice president of vendor relations, sourcing and compliance at Top 40 supplier Koozie Group .

Rong believes that electronic/tech products will experience some of the most significant shortfalls in inventory depth. “The severity of the global chip shortage has gone up a notch, and I anticipate it will get worse as retailers start to stock up for Q4,” Rong says.

As buying for the holiday season intensifies, gaps in apparel stock could widen, too.

“I expect inventory shortages in apparel to last into the first half of 2022,” says Jeremy Lott, who ranks first on Counselor’s Power 50 list of promo’s most influential people and who is CEO/president of SanMar, the industry’s largest supplier. “Tremendous shortages in yarn and other raw materials is hampering our ability to re-inventory.”

Industry-wide, suppliers this year have already increased pricing on virtually all product categories to offset soaring costs they’re experiencing related to shipping/importing, raw materials, labor and transport. Those cost pressures aren’t abating and could even intensify in the weeks and months ahead, according to some executives.

As such, additional price increases are already in the works and more could possibly follow later in the year. As just one example, Polyconcept North America, the industry’s fourth largest supplier, plans to implement price increases on August 2. PCNA, like other suppliers, had previously increased pricing in the spring.

“While we have made every effort to offset (rapidly rising costs), we are unfortunately at the point where that is no longer sustainable,” PCNA said in a communication to customers. “We hope conditions improve and this will be the last pricing action we need to take for the balance of 2021.”

A Broken Supply Chain

Just like PCNA, good suppliers throughout promo are working hard to tackle inventory challenges and to keep price hikes at a minimum. Still, they’re dealing with factors that, to a large degree, are beyond their control.

If you would like to read the rest of the article… contact us for the link…..

June 2021

FedEx Cuts Off Some Customers, Imposes Fees

By Christopher Ruvo

June 24, 2021

FedEx Corp. cut off its Freight service to about 1,400 customers earlier in June to ease pressure on its overstretched network, news that comes as the delivery services company imposes a shipment fee on Freight deliveries in particular parts of the countryThe Wall Street Journal reported that FedEx “dropped the customers without notice, leaving some businesses hunting for a new option to move their products.”

Service had reportedly been restored to hundreds of the suspended customers, but not all as of this writing.Commenting to WSJ, a FedEx spokesperson said the company temporarily dropped the customers “to minimize network disruptions and balance our capacity and demand to avoid backlogs across the country – particularly in the most capacity-constrained Freight service centers.”

According to some researchers, the COVID driven surge in online orders of items that then need to be delivered to homes and businesses has strained FedEx Corp.’s resources, resulting in the company not being able to get packages to destinations on time at the same rate as competitors like United Parcel Service (UPS) and the United States Postal Service (USPS).

Meanwhile, FedEx is instituting a $30 per shipment fee on FedEx Freight deliveries after July 5,

in certain zip codes. Those include the Sacramento, CA, Seattle, and Miami locales, as well as parts of New Jersey and Long Island, NY. The fee, like the service reductions, are aimed at addressing capacity constraints, FedEx told the Journal.

In April, FedEx Corp. entered the promotional products industry with its FedEx Office subsidiary through a partnership with Texas-based promo distributor Harland Clarke

Port Backlog in China Could Take Weeks to Clear

By Christopher Ruvo

June 24, 2021

A major port in China is reportedly resuming normal operations following a COVID-19 outbreak that had crippled the bustling hub. But a backlog of shipping containers could still take weeks to clear, spelling more supply chain disruption for western importers, including those in the promotional products industry.

Yantian International Container Terminal, a deep-water port in Shenzhen, Guangdong, China, through which about a quarter of that country’s exports flow, was ramping back up to normal operational capacity on Thursday, June 24.

Operations at Yantian were running at only 20% capacity recently after new cases of coronavirus began spreading among dock workers in late May, according to shipping analysts.

The disruption has already lasted weeks. For instance, the west port area, which is now reopening, was fully closed for a three-week period from May 21 to June 10, Seatrade Maritime News reported. COVID’s gumming up of the works at Yantian has caused delays and congestion at ports across the Pearl River Delta, The Loadstar reported.

“Delays for berthing at Yantian continue to be reported as 16 days or longer, and congestion is growing at the nearby ports of Shekou, Hong Kong and Nansha, which Maersk reported as being two to four days on 21 June,” Seatrade Maritime News reported. “Even with Yantian resuming full operations, congestion and impact on container shipping schedules will take weeks to clear.”

Some analysts think the disruption tied to COVID flare-ups in China could be even more profound. Brian Glick, founder and CEO of supply chain tracking platform Chain.io., told Sourcing Journal that the outbreaks have the potential to stall brands’ shipments for months to come, potentially cutting into the spring 2022 selling season.

“What I’m hearing from customers is that they’re trying to book space [on ships] now two and three months out,” Glick told Sourcing Journal. Normally, such bookings occur days or weeks in advance. The congestion is going to overflow into the peak season, which occurs from mid-August through the end of October, said Glick, adding that it’s already intensifying.

The upshot is that shipping containers could become even harder to procure, space on ships more difficult to get, and delivery of products made in China could take even longer to reach North America.

That spells continued problems for the promo industry, which has been experiencing inventory shortfalls due to the importing challenges that have arisen from the shipping issues, which are largely beyond the control of promo suppliers. The wildly skyrocketing costs for containers and cargo transports have also been a key factor driving up prices on promotional products in North America. With more importing and inventory issues expected, it would be wise for promo distributors to plan for the busy Q4 holiday gifting season now

Supply Chain, Inventory Woes Persist and Could Worsen

The supply chain issues that have been driving up product prices and causing inventory shortfalls in the North American promotional products industry during the economic recovery that’s followed COVID-19 shutdowns show no signs of abating and could potentially worsen.

That’s the message from industry suppliers who have been trying to mitigate the issues in order to provide sufficient quantity of quality cost-effective products in a timely fashion to help fuel promo’s sales recovery from the pits of the pandemic.

Accounts from distributors indicate that demand for promo items has been

increasing significantly in recent weeks, as the U.S. reopens and life returns to something closer to a pre-coronavirus normal amid advancing vaccination rollout, the lifting of societal restrictions, easing of mask mandates and the return of in-person events.

Still, shipping/fulfillment issues, rising raw material/labor costs, difficulties suppliers are having hiring enough staff, unfavorable exchange rates and other factors are contributing to insufficient inventory, higher product prices and lengthened delivery times for orders, which make it more challenging for distributors to meet client needs and capitalize on rising demand for branded merchandise.

UPS, FedEx Increase Shipping Surcharges

As if the promotional products industry isn’t facing enough shipping challenges, now the two biggest carriers in the United States are jacking up their peak surcharges.

UPS has increased surcharges on international shipments from multiple locations in Asia to the U.S.

FedEx has also announced increased fees on a variety of services, all with effective dates of June 21, 2021, until further notice. A peak surcharge of $3.50 per package (up 50 cents from the surcharge implemented in January) has been added to U.S. Express Package Services,

U.S. Ground Services and International Ground Services. FedEx Ground Economy Package Services’ peak surcharge increased 25 cents to $1 and the Peak – Residential Delivery Charge for FedEx Express and FedEx Ground domestic has doubled to 60 cents.

UPS and FedEx’s increased surcharges are another hurdle for industry firms contending with escalating shipping costs, lack of containers, rising raw material prices, depleted inventory, extended delays and a labor shortage. One supplier has called it the worst supply chain disruption he’s seen in nearly 30 years.